1

At the World Economic Forum in Davos in January, Chinese President Xi Jinping delivered a message on China’s promoting a “Fair Economic Globalization”, which explicitly contradicted the the newly elected US president Donald Trump’s “antiglobalist”. Since that time, the topic of PRC turning into a new leader of globalization keeps appearing on the pages of popular and specialized economic publications.

So what is the current state of Chinese economy?

The following is a brief review of the key data in China’s economic performance in 2016.

GDP growth — 6.7%. Specifically, in the service industry — 7.8% growth, in manufacturing and construction industry — 6.1%, in agriculture — 3.3%. It is important to note that China has maintained its GDP growth at a level between 7% and 14% per year for more than 25 years.

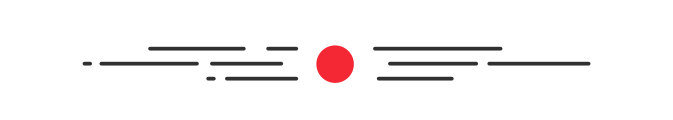

As a result, China’s GDP has been the world’s largest in terms of purchasing power parity since 2016 (Fig. 1).

It should be stressed that these data represent the purchasing power parity of national currencies, in other words, based on real economic capacity for 2015. Thus, today, in 2017, China’s leadership has become even more evident.

More figures for 2016.

Investment in fixed capital has grown by 8.1%, reaching 59.65 trillion yuan (about $9.5 trillion). However, the share of private investments in fixed capital has decreased over the year from 64.2% to 62.2%, the rest (about $3.6 trillion) was invested by the government.

A trend towards advanced development of high-technology industries persists (an increase of 11%). Production of electric vehicles has grown by 58.5%, industrial robots — by 34.3%, smartphones — by 12.1%. The share of service industry in the GDP has increased by 51.6%, with a major contribution to GDP growth made by the share of final consumption expenditure in the domestic market (64,6%). It shows that China’s economy has largely overcome its dependence on export trends.

In 2016, the volume of the external trade dropped by 6.8% (amounting to $3.685 trillion), exports by 7.7% (amounting to $2.097 trillion), imports by 5.5% (amounting to $1.588 trillion). External trade surpluses totaled $510 billion and declined by $84 billion compared with 2015. The turnover with the EU decreased by 3.1%, with the USA – by 6.7%, with ASEAN countries – by 4.2%, with Japan – by 1.3%, with South Korea – by 8.5%. The two main reasons why the volume of the external trade declined were the stagnation of the global economy and existing trade barriers, such as anti-dumping duties that the US and a number of other countries keep imposing against China.

In recent years, the major Chinese banks have become global, taking the top places in the world assets ranking. Already in the beginning of March 2016, The Financial Times reported that the Chinese banking sector had become the most powerful in the world with $33 billion, exceeding the total assets of the Eurozone ($31 billion), the USA ($16 billion) and Japan ($7 billion).

Moreover, the PRC established a developed network of medium and small size banks, including regional banks. The total amount of loans they issued in 2016 was a record 12.65 trillion yuan, which was almost 1 trillion yuan more compared with 2015. 50% (6.35 trillion yuan) of them were household loans, 48% (6.1 trillion yuan) were loans to non-financial enterprises.

Money supply (M2) in the economy (cash and noncash) as of the end of 2016 grew by 11% and totaled 155 trillion yuan (more than twice the country’s GDP). It is the highest growth rate among major economies. It means that the level of monetization of the PRC is more than enough (some Western experts say that it is even superfluous, and therefore, wrong and dangerous). However, this does not accelerate inflation, despite the theories of neoliberal economists (including Russian ones). According to the Bureau of Statistics of China, the inflation rate for 2016 was only 2%.

So far, a number of industry-specific production capacities of the Chinese economy is superfluous: neither the domestic, nor the global market absorbs its products. Therefore, since 2016 China declared a campaign against redundant capacities as one of the structural priorities of its economic policy, first of all in the coal and steel industries.

The thing is that in recent decades, China has developed huge production facilities in a number of heavy industries, including coal and energy, metallurgy, construction, glass, etc. to ensure a high rate of gross domestic product growth and at the same time to promote export expansion. Today, in the context of the ongoing global crisis and shrinking global demand, these facilities are not used at their full capacity.

That is why the coal industry was tasked to reduce its extracting capacity by 500 mln tons in 3 – 5 years. In 2016 the number of reduced industrial capacities was around 300 million tons, which also affected 620 thousand jobs. In 2016 the steel industry had to reduce its capacity of low grade steel production by 45 mln tons, this task has also been completed.

The side effect from the implementation of this structural reform that is just beginning to unfold in China is increased unemployment. More on this below.

Why do China’s achievements worry developed countries, especially the USA, rather than impress them?

The data presented show clearly that China is becoming an economic giant quite comparable to the US. Moreover, it is emerging as an obvious candidate to play the role of an absolute leader. This fact, the possibility of losing leadership, deeply concerns the US for good reason . And it has not started just today.

There is a professor in the USA by the name of Peter Navarro from Columbia University, who was now assigned by Trump to the position of the Director of National Trade Council. Navarro wrote a number of books exposing the “expansionist ambitions” of China. Among these books are Death by China and Crouching Tiger that Trump says to have carefully read.

The books are quite old. However, many of Navarro’s forecasts regarding China’s growth rate and its global ambitions have come true.

In the spring of 2016 the World Bank shared data about ten countries with the highest figures of trade balance surplus and deficit. The situation in 2015 looked as follows.

Trade surplus in billions of dollars

China – 600;

Germany – 275;

Russia – 161;

South Korea – 90;

Netherlands – 53;

Taiwan – 52;

Singapore – 50;

Italy – 50;

Ireland – 49;

Qatar – 45.

Trade deficit in billion dollars

USA – 803;

Great Britain – 163;

India – 126;

France – 78;

UAE – 69;

Turkey – 63;

Hong Kong – 49;

Egypt – 44;

Spain – 27;

Pakistan – 22.

As we see, China is already a world leader in trade expansion into global markets.

On March 6, 2017, China’s official daily newspaper, Renmin Ribao (People’s Daily) reported that China’s contribution to the growth of the global economy reached 33.2% in 2016. It means that China maintains its position as the main “driving force” (even bigger than US!) of the global economic growth.

Furthermore, the USA has long ago ceded its leadership to China in real production almost in all segments of the economy and in the scale of exports. Thus, in 2016, the EU’s total exports were $2.5 trillion, equal to the exports of China and Hong Kong together, the US’ exports were less than $1.5 trillion.

Until recently, it was thought that the USA would maintain its leadership position in production of intellectual IT-products for much longer. However, already in 2012, the Chinese company Lenovo outranked the American Hewlett-Packard and became the world leader in PC sales. In 2014 Lenovo emerged as a world leader in laptop sales as well. The Chinese Huawei corporation has already outperformed the international Ericsson corporation in telecommunications equipment production volume.

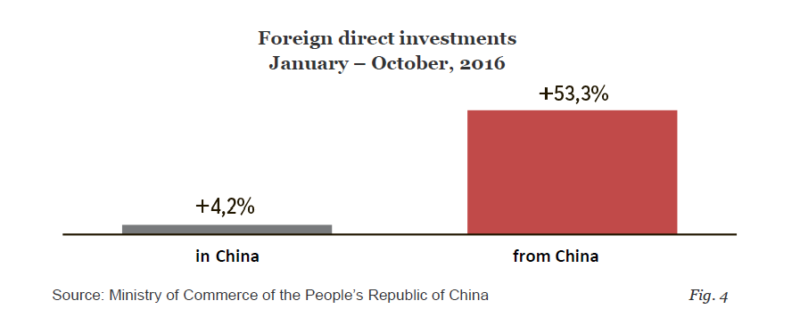

China is also rapidly approaching the US in such important indicators as inward and outward foreign direct investment (FDI). While in 2007 China’s outward FDI was around $19 billion (1.3% of the global value), in 2015 it amounted to $128 billion (8.7% of the global value), to a total of $183 billion (12.3% of the global value) together with Hong Kong. Even though the outward FDI of US is now much higher than that of China and amounts to $300 billion (20% of the global value) it should be noted that in China this indicator grew by a factor of almost 10 in 10 years. Last year, the outward FDI from China demonstrated impressive growth (Fig. 2).

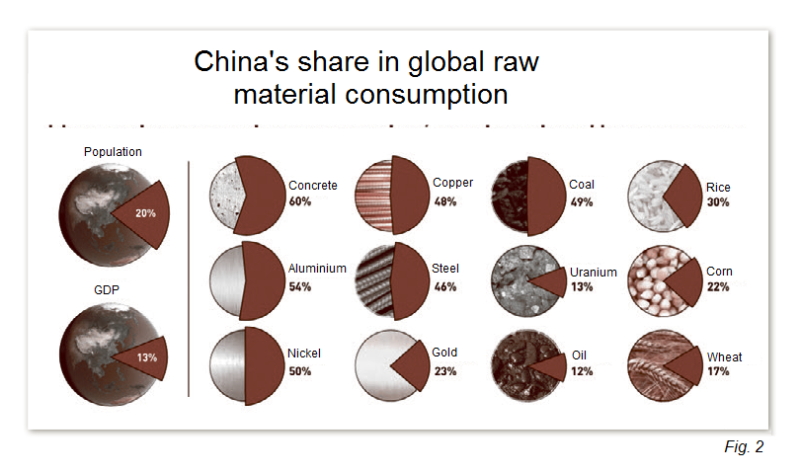

It should be stressed that it is not just a temporary and accidental “outcome”. There is such an indicator in the economy as net international investment position. It is comprised of the difference between the foreign assets and foreign liabilities accumulated over time. So, China’s net international investment position was better than that of US already by the beginning of 2015 (Fig. 3).

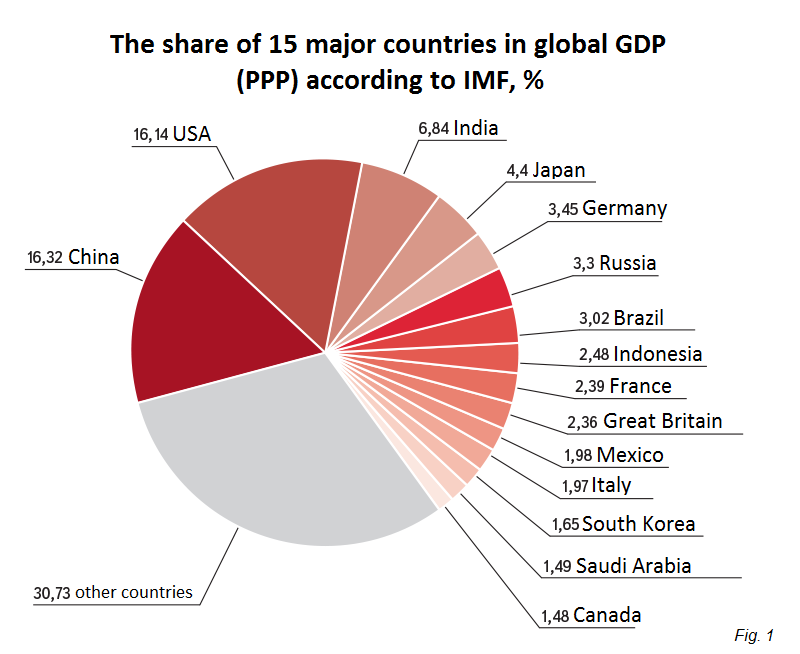

Finally, China is the world’s leading consumer of a large number of raw materials and other goods. Last year we already discussed this fact. I think it is worth recalling this again (Fig. 4).

As we can see, China consumes approximately half or even more of the global production of steel, copper, aluminum, nickel, concrete, coal, and it is the biggest consumer in the world of many other products.

That is why China is more obviously seeking to become the main “price dictator” on the key global commodities markets. With this end, already in the 1990-s, China established the Shanghai Future Exchange and Dalian Commodity Exchange. Today, China plays a decisive role in determining global prices on a variety of metals, primarily steel, copper, rare earth metals. For example, in 2016 the daily average turnover of futures for copper at the Shanghai Exchange was 3.02 million tons, while its main competitor, the London Metal Exchange, totaled half as much, around 1.5 million tons.

In May, 2016, Fang Xinghai, Vice-Chairman of the China Securities Regulatory Commission, said at the International Conference on Commodities, “China has a chance to occupy for good the position of the global leader in establishing prices on commodities … it would be a historic mistake to neglect to see this rare opportunity.”

In February, 2017 China announced the report of the National Development and Reform Commission on the country’s development plan for the same year. Here are some figures from the plan:

- GDP growth will comprise 6.5% and above;

- Direct nonfinancial investments abroad will grow to $170 billion;

- Investments in railway network development will total 800 billion yuan (around $116 billion);

- Investments in road and water transport infrastructure will reach 1.8 trillion yuan (around $262 billion);

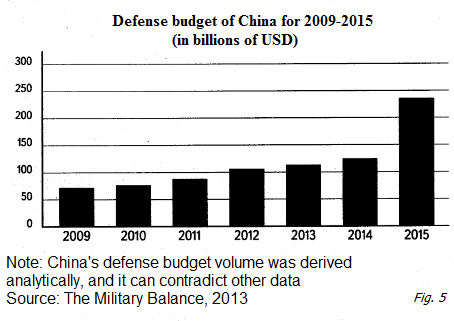

- Defense spending will grow by 7%, reaching $156 billion.

It should be noted that according to international analysts, China’s official military spending has been underestimated, because a significant part of the costs in the budget is being transferred to “non-miltary” ministries and agencies. This way, the official international journal The Military Balance estimated the total military budget of China in 2013 at $240 billion (Fig. 5).

In early March 2017, China announced a program of achieving technological and industrial independence in key industries by 2025. International experts named the program, the implementation of which would cost $300 billion according to the plan, “Made in China 2025”. The main mechanisms for implementation of the program are long-term low-cost loans provided by public investment funds, support to Chinese corporations in acquiring foreign competitors, and huge public research and development grants.

Li Keqiang, the Premier of the State Council of the People’s Republic of China, while announcing the program, said, “Our aim is to develop and commercialize new materials, artificial intelligence, integrated circuits, biotechnologies, 5G mobile communications, and other technologies, as well as to establish industrial clusters in these areas… and to launch independent manufacturing of modern aircraft, robots, electric vehicles, railroad equipment, ships, and agricultural equipment.”

It should be noted that China’s share in global R&D spending is rapidly growing and has reached 20.4% in 2016. The US’ share is 26.4% which, according to experts, will be surpassed by China by 2026. No wonder that in 2015 more than a third, which is approx. 1 mln of 2.9 mln patent applications requested globally, were received from China.

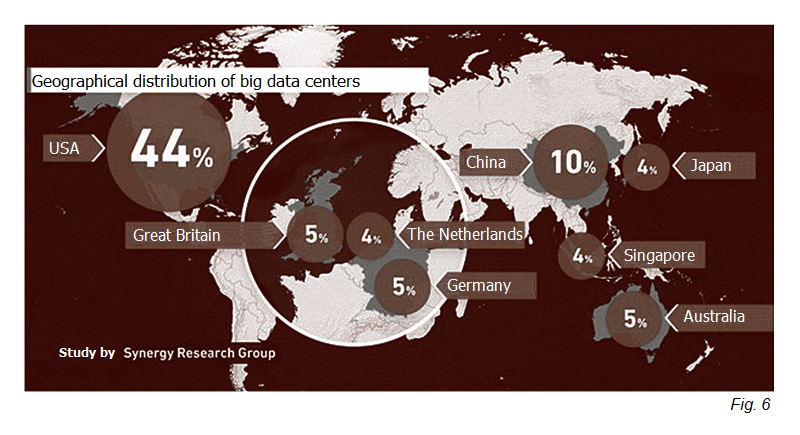

As for high-tech IT solutions, today China ranks second in the world after US in the number of established integrated data centers (Fig. 6).

As we see, the number of China’s big data centers is twice that of such developed countries as Great Britain and Germany.

China is recently paying a great deal of attention to high tech sector. Let us list just a few facts.

In light of Donald Trump’s intention to limit foreign workers in all sectors of the US economy, China has encouraged experts (including immigrants) to move from California’s Silicon Valley to China’s Silicon Valley, Zhongguancun. The experts are promised to receive financial support of approximately $1 million for every new company (startup) they start in China.

As early as 2015, China announced its intention to invest 1.2 trillion yuan (almost $200 bln) in the period from 2016 until 2018 in the development of information infrastructure. On January 22, 2017, the Xinhua News Agency reported that China’s government has established a 100 billion yuan ($14.6 billion) fund to invest and support internet industry in order to make China a global leader in internet technologies. The fund has already raised 30 billion yuan offered by banks and telecommunication companies, the State Council of the PRC informs.

In February Bloomberg reported that Weibo, a social media platform, China’s closest analogue to Twitter, overtook the American micro-blogging service in terms of market value.

The manufacturing and use of industrial robots has soared in China. Today, China purchases approximately 15% of all industrial robots manufactured in the world. For example, in February the Changying Precision Technology Company factory, which produces cell phones, replaced 90% of its employees (which was approximately 650 workers) with robots. The company’s production rate has since increased by a factor of 2.5 and the product defect rate has decreased by 80%.

However, China develops high technologies not only in IT. On February 16, the newspaper Renmin Ribao reported that China made the first shipment of low-pressure heaters for nuclear power plants to the French corporation Électricité de France (EDF). The equipment was developed and manufactured by the Chinese Dongfang Electric Heavy Machine company. The country’s nuclear industry has gained experience in building and operating powerful domestic-made nuclear units, and it has adopted an urgent nuclear energy capacity building plan.

On March 5, 2017, the newspaper South China Morning Post reported that China launched the world’s largest deep-water semi-submersible drilling rig Bluewhale I with its weight of approximately 200 thousand tons and operating depth of up to 3700 meters. (Note: the name has nothing to do with an outrageous meme of the “Blue Whale” children’s suicide websites)

Finally, as early as 2016, China announced that it will assemble its own orbital experimental space station, Tiangong, by 2022. It means that China will become a global leader in manned space research missions. Two types of cargo spacecraft to deliver heavy lift cargo to the station have been developed and are at the testing phase.

Clearly, given the abundant forecasts of Western analysts that China or its economy is on the verge of collapse, the above-mentioned achievements of the country are very concerning for the US. Donald Trump made such concerns one of the themes of his presidential campaign saying that if he becomes the President, the USA will start a “trade war” against China. Particularly, it would punish Beijing for the undervaluation of its national currency, which gives Chinese businesses competitive advantages in international trade, as well as for non-market preferences for direct and indirect state export subsidies supposedly received by Chinese public and private companies.

Possible “punitive” measures for Chinese export that have already been published in the American press include huge barrier fees of up to 40 – 50% and above, import duties on Chinese goods, and restrictions on China’s export quotas in the US, including measures under Sections 201 and 301 of the US Trade Act of 1974, aimed at countering import surges and unfair competition.

So far, the new Administration has not applied any of these measures, except for another increase in import duties on Chinese steel. Moreover, Trump’s newly appointed Treasury Secretary, Steven Mnuchin, does not mention now that China has artificially kept the yuan undervalued. Even the President’s rhetoric on the issue of economic cooperation with China has changed, he does not call China a “currency manipulator” any more. Trump organized a rather lavish reception of China’s president Xi Jinping during his visit to US, and said that they had “a very successful” meeting.

So for today, it is highly uncertain whether the US policy on initiating a trade war against Beijing as announced by Trump will be pursued. The US is more likely to prefer to negotiate with China. A clear indication of this are rather large mutual trade concessions made by Beijing and Washington which were agreed upon on May 12, 2017, as a result of difficult negotiations that lasted for more than three months. Following the negotiations, in July 2017 the US opens its national market of major infrastructure projects to Chinese corporations, and provides better opportunities for poultry export from China to the US. Beijing in its turn opens the Chinese market to a number of American banks and rating agencies, and also to American beef, genetically modified seed, and, take note: to American liquefied natural gas!

What are other Chinese initiatives that US and the West are concerned about?

The trade imbalance with Beijing and its global financial expansion worry US and the West in general as much as China’s global infrastructure and integration projects. Primarily, the One Belt, One Road initiative (OBOR) announced by Xi Jinping in 2013, or the New Silk Road initiative.

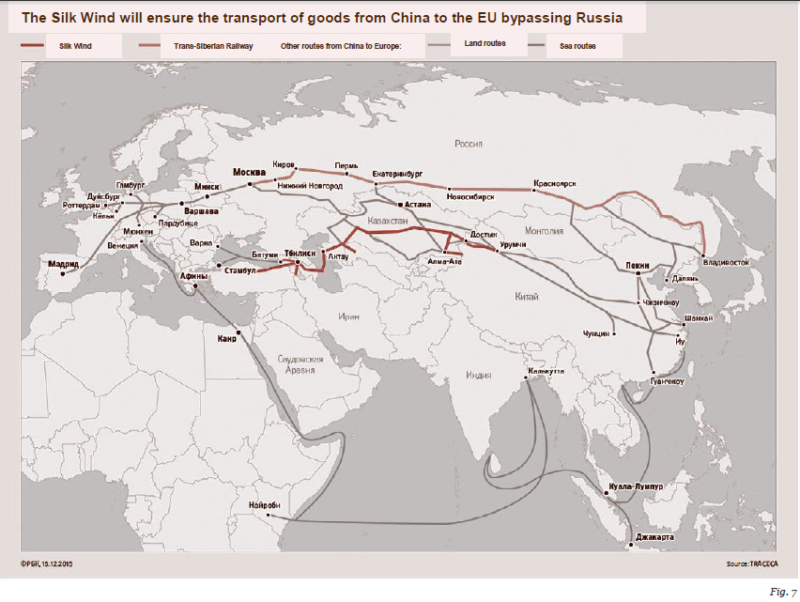

The project consists of two major parts: the Silk Road Economic Belt and the 21st-century Maritime Silk Road and includes networks of land-based routes such as railways and highways, and sea/ocean routes (Fig. 7).

Unfortunately, while the press released no full and detailed project designs, different sources draw different maps in accordance with their wishes. It is likely that the reason for the absence of detailed designs is that Chinese authors have not finalized the project yet, or they do not want to show all the aces before their due time. Thus, for example, land-based routes running to the South via Indochina and Pakistan have been represented on separate maps. These are in particular, the China-Pakistan Economic Corridor and the South Corridor running via Myanmar to the Bay of Bengal that we analyzed in this periodical earlier in the context of oil and gas wars.

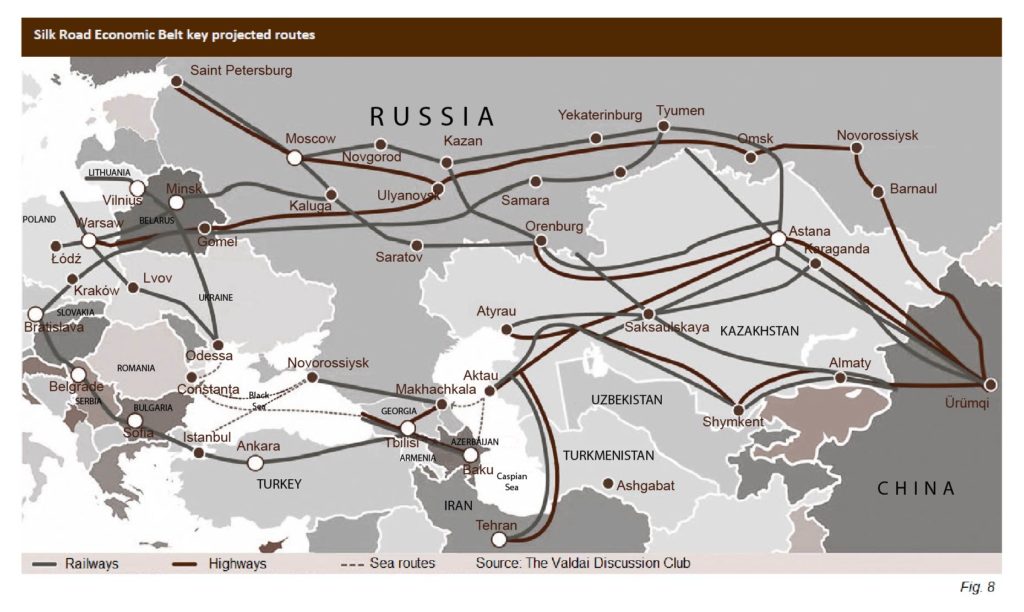

By all means, even the land routes to Europe and Middle East of OBOR project are impressive. This part of the project includes several corridors running via different countries (Fig. 8).

As we can see here, there are routes via Russia and Kazakhstan to Europe and Iran, there are routes via the Caspian Sea, Transcaucasus and Turkey, etc.

(To be continued)

Source (for copy): https://eu.eot.su/?p=15575&preview=true

This is the translation of the first article (first published in “Essence of Time” newspaper issue 230 on June 2, 2017) by Yury Byaly.