07.08.2024, Riyadh.

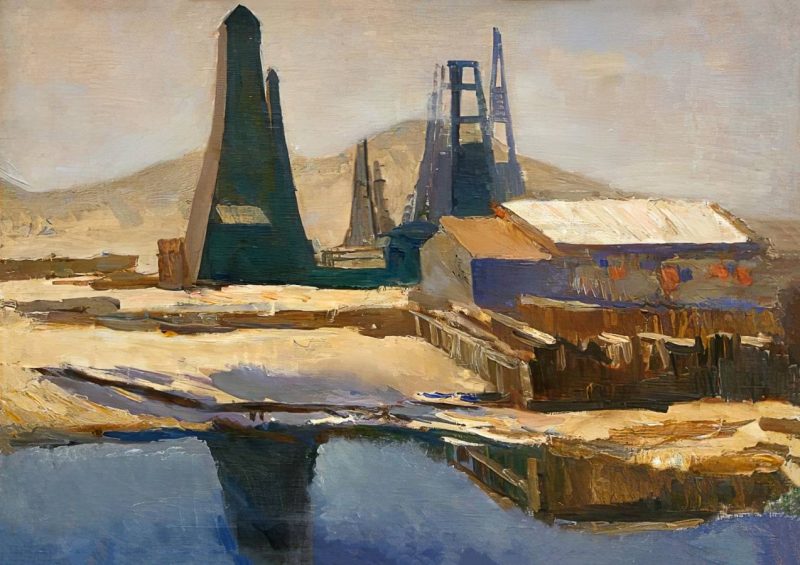

Saudi Aramco is acquiring a 22.5% stake in the Petro Rabigh refining and petrochemical complex from Japan’s Sumitomo Chemical, located on the west coast of Saudi Arabia, as reported by the company’s press service on August 7.

The deal amounts to $702 million. Currently, Aramco and Sumitomo Chemical each hold 37.5% of Petro Rabigh’s shares.

After the deal closes, Aramco will become the largest shareholder of Petro Rabigh with an approximate 60% stake, while Sumitomo Chemical will retain 15%.

Aramco notes that this transaction is part of a program to help Petro Rabigh recover its financial situation. For the fiscal year 2023, Petro Rabigh reported revenue of $14.9 billion but incurred a net loss of around $300 million.

Under the terms of the share purchase agreement, all proceeds received by Sumitomo Chemical from the sale will be reinvested in Petro Rabigh. Additionally, Aramco will provide Petro Rabigh with an additional $702 million, bringing the total investment to $1.4 billion.

Moreover, Aramco and Sumitomo Chemical have agreed to gradually phase out shareholder loans of $750 million each, which will directly reduce Petro Rabigh’s liabilities by $1.5 billion.

The companies expect these measures to improve Petro Rabigh’s balance sheet. Going forward, the companies will consider initiatives to modernize the refinery to enhance business profitability.

Petro Rabigh’s refinery has a capacity of up to 400,000 barrels of oil per day. The plant produces gasoline, diesel fuel, naphtha, kerosene, and other petroleum products. The petrochemical complex produces up to 2.8 million tons of polyethylene, monoethylene glycol, polypropylene, propylene oxide, and other derivative products from oil, ethane, and butane supplied by Saudi Aramco.

Source: Rossa Primavera News Agency